When silicon becomes sovereignty

If you want to understand AI power in 2026, stop refreshing model leaderboards. Look at the supply chain.

Not the “AI supply chain” people mean when they talk about data pipelines. The real one: fabs, wafers, lithography tools, advanced packaging, grid capacity, water rights, export licenses, and the shipping corridors that keep all of it moving. That’s where the future is being negotiated—quietly, expensively, and with far more friction than most software people like to admit.

The financial scale alone is a tell. One widely cited projection pegs the global semiconductor market at about $659.66B in 2026, growing toward about $1.477T by 2034. That’s not a hobby market. That’s an industrial megacycle.

Source: https://www.fortunebusinessinsights.com/semiconductor-market-102365

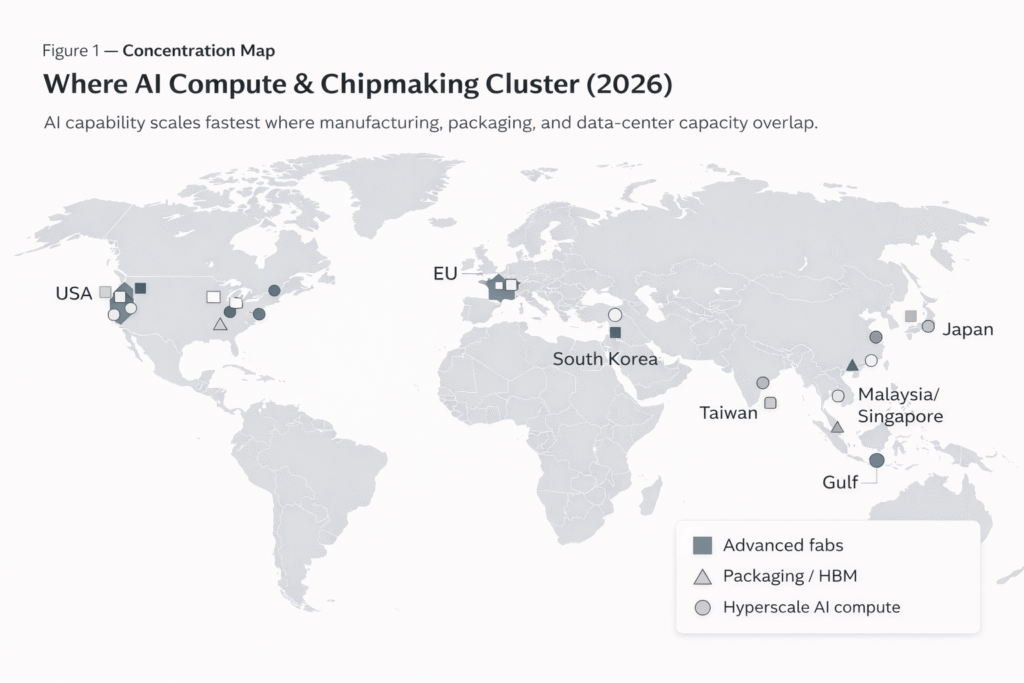

And the geography is a bigger tell. The same source reports Asia-Pacific holding 51.00% of global market share (2025). That’s not “global distribution.” That’s a lopsided foundation for a technology everyone wants to treat as universally accessible.

Source: https://www.fortunebusinessinsights.com/semiconductor-market-102365

So when people say “AI is the new electricity,” I half-agree. It’s more literal than they think. AI power is increasingly about controlling the infrastructure that produces and delivers compute—because compute is the scarce resource now.

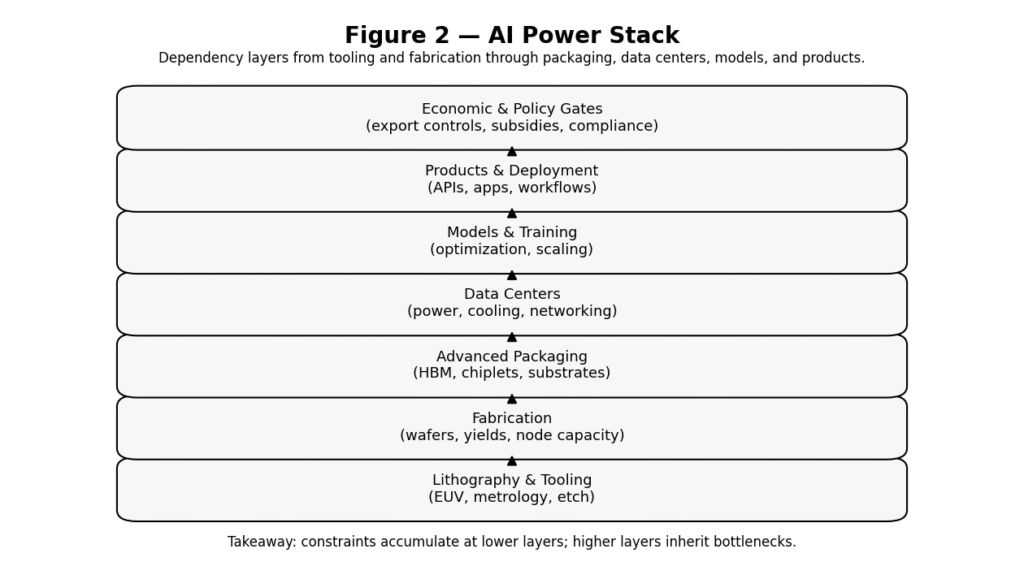

The AI stack starts below the cloud

Most “AI stack” diagrams begin with GPUs and end with applications. That’s convenient. It’s also misleading.

The decisive layer starts below GPUs:

- raw materials and specialty chemicals

- lithography tooling

- advanced-node fabrication

- advanced packaging (where AI performance increasingly lives)

- then: accelerators → servers → models → products

Once you treat AI as an industrial system, a lot of policy behavior starts making sense. The U.S. CHIPS and Science Act is not a vibes-based innovation campaign; it’s an explicit attempt to strengthen domestic capacity and supply chain resilience.

CHIPS Act (White House fact sheet): https://bidenwhitehouse.archives.gov/briefing-room/statements-releases/2022/08/09/fact-sheet-chips-and-science-act-will-lower-costs-create-jobs-strengthen-supply-chains-and-counter-china/

Europe’s equivalent is the European Chips Act, aimed at reducing dependencies and improving resilience.

EU Chips Act (European Commission overview): https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/europe-fit-digital-age/european-chips-act_en

These policies are admissions. If chips weren’t power, governments wouldn’t be writing semiconductor policy like strategic policy.

The cost curve is the reality check

Software scales with talent and time. Semiconductors scale with capital intensity and multi-year build cycles.

A leading-edge 3nm-class fab is now commonly anchored in the $15B–$20B range. Public sources consistently support the upper bound: the U.S. Congressional Research Service notes that advanced fabs can cost up to $20B, and industry reporting similarly points to $20B-class costs at the leading edge.

CRS (advanced fab cost up to $20B): https://www.congress.gov/crs-product/R46581

SEMI/DHL PDF (advanced fab cost context): https://www.semi.org/sites/semi.org/files/2022-12/glo-csi-dhl-resilience-of-the-semiconductor-supply-chain.pdf

Then comes the operating economics. Reports tied to foundry pricing expectations show 3nm wafers climbing above $20,000—a number that turns “compute efficiency” from a nice optimization into a primary business constraint.

3nm wafer price reporting: https://www.tomshardware.com/news/tsmc-will-charge-20000-per-3nm-wafer

If you’re building AI products at scale, those numbers aren’t trivia. They shape which strategies survive.

Control isn’t “who has GPUs”—it’s who owns chokepoints

People often reduce semiconductor power to “who has the most accelerators.” That’s the last mile of a longer story.

The real control points are upstream:

Lithography is leverage

Advanced manufacturing depends on extreme ultraviolet (EUV) lithography. ASML’s EUV systems sit at the center of that ecosystem. There’s no casual substitute for EUV at the leading edge.

ASML EUV systems: https://www.asml.com/en/products/euv-lithography-systems

Packaging is quietly strategic

For AI workloads, performance is increasingly constrained by memory bandwidth, interconnect, and integration—areas where advanced packaging matters as much as node size. IEEE Spectrum has covered how chiplets and packaging trends reshape performance and supply constraints.

IEEE Spectrum (chiplets/packaging): https://spectrum.ieee.org/tag/chiplets

Energy and water are hard ceilings

AI compute expands in megawatts. That means grid capacity, permits, and long-term power planning are now “AI roadmap” issues. The International Energy Agency has been explicit about the growing energy implications of AI and data centers.

IEA — Energy and AI: https://www.iea.org/reports/energy-and-ai

Semiconductor manufacturing also depends on large volumes of ultra-pure water, and research has documented the water footprint pressures that come with modern chipmaking.

Nature Sustainability (water footprint pressures): https://www.nature.com/articles/s41893-022-00966-w

Real-World Context: This is why your infrastructure coverage is one of AIChronicle’s strongest pillars. It’s the missing layer most AI commentary avoids. Two internal reads that naturally reinforce this article:

The Physical World Behind Digital AI: Servers, Energy, Water, and Land

https://theaichronicle.org/the-physical-world-behind-digital-ai-servers-energy-water-and-land/

Why AI Infrastructure Depends on Water

https://theaichronicle.org/why-ai-infrastructure-depends-on-water/

The market is growing, but the base is uneven

Market growth is easy to celebrate. Market structure is harder to talk about.

Market Growth (2026): $659.66B projected, with a forecast toward $1.477T by 2034

Source: https://www.fortunebusinessinsights.com/semiconductor-market-102365

Regional Concentration: Asia-Pacific at 51.00% share (2025)

Source: https://www.fortunebusinessinsights.com/semiconductor-market-102365

This matters because concentrated markets don’t behave like open markets. They price access. They reward incumbents. They invite policy interventions. They punish any strategy that assumes unlimited compute availability.

The most expensive race in history is happening in plain sight

If you want a concrete symbol of “silicon sovereignty,” look at the scale of strategic cluster investments.

Reuters-based reporting has described semiconductor cluster plans in South Korea reaching roughly 600 trillion won (~$407B) over time, including SK hynix’s Yongin cluster push. Even if you ignore the politics, the capital scale is the headline: this is industrial statecraft, not just corporate expansion.

Reuters reporting via Yahoo Finance (visible): https://finance.yahoo.com/news/exclusive-sk-hynix-speeds-chip-220217637.html

When investments look like that, AI stops being “software progress.” It becomes national capability-building, with winners determined by who can sustain multi-decade industrial projects.

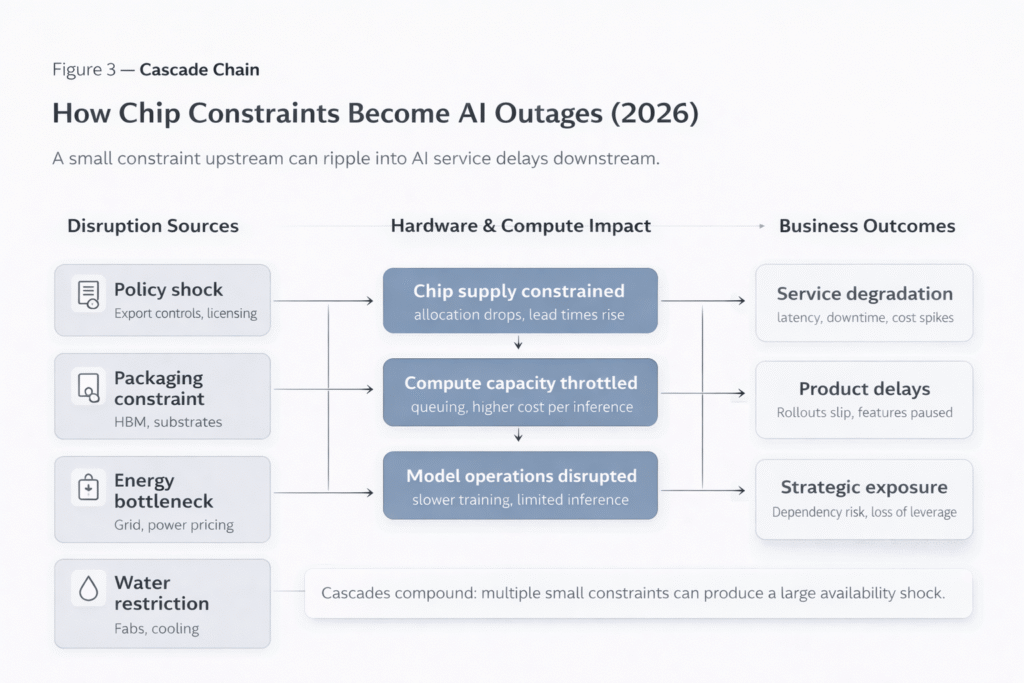

The five chokepoints that decide AI velocity in 2026

- Wafer allocation + pricing (3nm wafers above $20K reshape economics)

Source: https://www.tomshardware.com/news/tsmc-will-charge-20000-per-3nm-wafer

- Fab build economics (leading-edge fabs are $15B–$20B class projects)

Sources: https://www.congress.gov/crs-product/R46581 | https://www.semi.org/sites/semi.org/files/2022-12/glo-csi-dhl-resilience-of-the-semiconductor-supply-chain.pdf

- Regional concentration (Asia-Pacific’s 51% share signals structural asymmetry)

Source: https://www.fortunebusinessinsights.com/semiconductor-market-102365

- Energy constraints (grid capacity becomes a compute roadmap item)

Source: https://www.iea.org/reports/energy-and-ai

- Tooling dependency (EUV lithography is a critical gate)

Source: https://www.asml.com/en/products/euv-lithography-systems

Control two of these and you have leverage. Control four and you have an edge that looks a lot like dominance.

open models won’t democratize chip power

Open-source AI is real. It matters. It will widen access to capabilities.

But it will not break semiconductor power.

Open weights don’t manufacture wafers. Open code doesn’t build fabs. Open licensing doesn’t bypass export controls, packaging shortages, grid bottlenecks, or water constraints. The constraint is physical capacity, not software permission.

In fact, wide-open adoption can increase demand pressure on the same concentrated hardware base—making chokepoints more valuable and scarcity more strategic.

So the honest outcome may be: broader usage, deeper dependence.

Real-World Context: If you want the human-facing consequence of dependency—how reliance becomes normal, then risky—your internal piece connects cleanly here:

The Hidden Risks of Relying on AI

https://theaichronicle.org/the-hidden-risks-of-relying-on-ai/

The Old AI Race vs The Chip-Constrained AI Race

Referenced sources behind the table claims:

Market size + Asia share: https://www.fortunebusinessinsights.com/semiconductor-market-102365

3nm wafer pricing: https://www.tomshardware.com/news/tsmc-will-charge-20000-per-3nm-wafer

Energy constraints: https://www.iea.org/reports/energy-and-ai

EUV dependency: https://www.asml.com/en/products/euv-lithography-systems

By 2027, AI leadership will be measured less by benchmark wins and more by compute reliability under stress. The actors that can maintain capacity through pricing volatility, packaging constraints, grid delays, and policy shifts will set the pace for everyone else.

By 2028, “compute sovereignty” will move from think-tank language into routine business planning in AI-dependent industries. You’ll see it in procurement contracts, board risk registers, and infrastructure roadmaps. The data points already point in that direction:

market scale trajectory (semiconductor growth forecasts)

https://www.fortunebusinessinsights.com/semiconductor-market-102365

capital intensity at the leading edge (fab costs)

https://www.congress.gov/crs-product/R46581

unit input pressure (3nm wafer pricing)

https://www.tomshardware.com/news/tsmc-will-charge-20000-per-3nm-wafer

megaproject signaling (Yongin / $400B+ class investment)

https://finance.yahoo.com/news/exclusive-sk-hynix-speeds-chip-220217637.html

The next era of AI power won’t be decided by who writes the cleverest architecture paper.

It will be decided by who can answer a dull, decisive question with confidence:

Where does your compute come from, and what breaks it?